Since 2020, 14 councils around the country have turned to residents and the wider public to borrow money to fund a range of initiatives in their climate emergency plans, from solar PV to sustainable drainage to planting trees. West Berks and Warrington were the first in 2020 raising £1m each. Over the following 3 years, another 7 councils followed suit, with 6 in 2024 alone.

Called Community Municipal Investing (“CMI”), everything suggests borrowing from residents is here to stay… again. Many council officers will remember there is nothing new in the principle of borrowing from citizens and it was a regular occurrence up until the 1980s. The administrative burden and costs of those paper-based bond raises meant they fell out of use – CMI is repurposing the approach for a digital age.

The model was developed in partnership with University of Leeds and a handful of pioneering councils and designed to mirror as far as possible the ease of use of the Public Works Loan Board both at time of the raise and ongoing. All the administrative work relating to citizen investors is outsourced to Abundance, and Abundance also holds the Financial Conduct Authority regulatory permissions required to offer investments to members of the public.

With 15 councils now forming a CMI Steering Committee, the goal is to develop CMI for the benefit of all councils and make borrowing from residents a regular, repeat and materially cheaper alternative to PWLB.

Why do this – what are the benefits?

Councils’ legal status, their ability to raise revenues and the strict rules which govern their finances combine to make lending to councils low risk. That means the interest resident lenders expect is also lower than many of the options available for their money and crucially below the rate charged on borrowings from PWLB. As the product becomes better understood savings can be expected to increase from the current average of 0.28% to closer to 0.75% At scale, the cost savings can quickly mount to millions of pounds.

As much as the cost savings, the value of CMI lies in its potential to add a different but highly engaging plank to the relationship with residents. Giving citizens the opportunity to fund low carbon initiatives in their communities is capturing their attention – Southwark’s email to residents about its first loan saw 400 of them sign up within 48 hours to learn more. Semi-annual updates on what their money is doing provide positive reinforcement and a platform to inform and inspire.

An encouraging sign is that different to traditional investments CMI investors are spread evenly across the 10 deciles of the Index of Multiple Deprivation, making CMI a powerful tool for engaging a broad spectrum of the community.

How does CMI work and how to use it

CMI uses a simple standard loan agreement drafted with the input of 4 councils so that investors only need to focus on a few key terms for each loan (rate, maturity, repayment method). Abundance conducts due diligence relying predominantly on information that is already publicly available and focused on the current and near-term financial stability of the borrowing council. Once the first loan has been raised, execution of each subsequent loan is even easier.

Abundance manages all the money flows (including payment of interest) throughout the life of each loan, and all the financial regulatory requirements.

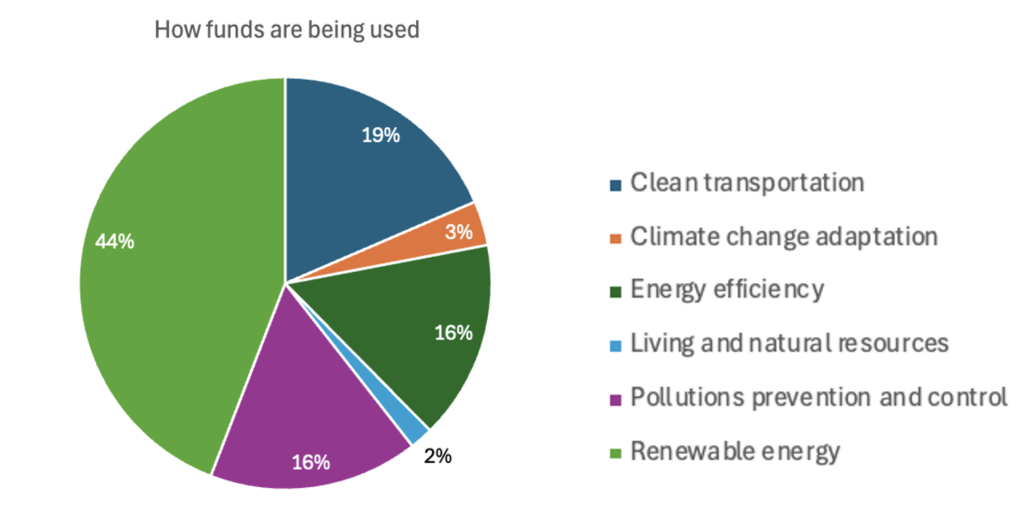

The principal input of the council centres on how the funds will be used and how best to leverage the communication and engagement opportunities that come with borrowing from residents. Each new loan is building valuable experience on what works well – Abundance supports the marketing efforts of each borrower with the Steering Committee also committed to developing and sharing marketing best practice.

So far all loans have been 5 year (though the expectation is to start to increase term periods offered in 2026) and most are amortising (repaying capital and interest every 6 months).

How big can CMI get?

2025 will be the biggest year yet for CMI – 3 councils have already launched loans and 10 are lined up for the rest of the year. Roughly half are doing their second, third and even fourth raise, the other half are embarking on their first. That’s another step towards making CMI a standard borrowing option, raising hundreds of millions to save millions each year.

The FCA in 2023 estimated that over £1.5 trn sits in low to no interest savings accounts. With 52% of savers and investors interested in lending to councils, (including almost half of the 83% of people who are indifferent or negative about their council) that presents a huge opportunity for councils to borrow from residents and:

And finally with a growing pool of councils listing on the platform, Abundance is starting to attract interest from socially minded institutional investors who like the Gilt like return of CMIs but also value the place-based impact and are happy to invest alongside citizen investors on the platform. We expect this to support volume growth over the next 2-5 years as the citizen investor community grows.

If this interests your council, you can find more information on what CMI is and how it works in this guideprepared by the Green Finance Institute or contact Abundance directly on support@abundanceinvestment.com.

Karl Harder

Karl Harder is co-founder and managing director of Abundance Investment. For 12 years Abundance has enabled people to invest to help finance the transition to a Net Zero UK. Abundance was the first UK platform to be regulated for crowdfunding and has raised over £150m. Abundance is primarily focused on raising money for councils to fund their climate and regeneration schemes. In turn providing a high impact saving option for residents, but also a tool for engaging residents with their council and local government more broadly.

Achieving Maximum Impact on Net Zero

Tell us your views on "How Local Authorities Can Achieve Maximum Impact on Net Zero?" - Click and respond to Question 1 on this page

Issues that should be addressed

Tell us your views on "What Critical Issues a Climate Statutory Duty Should Address?" - Scroll down page to Question 2

Creating solution for local authorities

We want to create solutions for local authorities. Tell us what problems you are experiencing and, we will find solutions. Click here